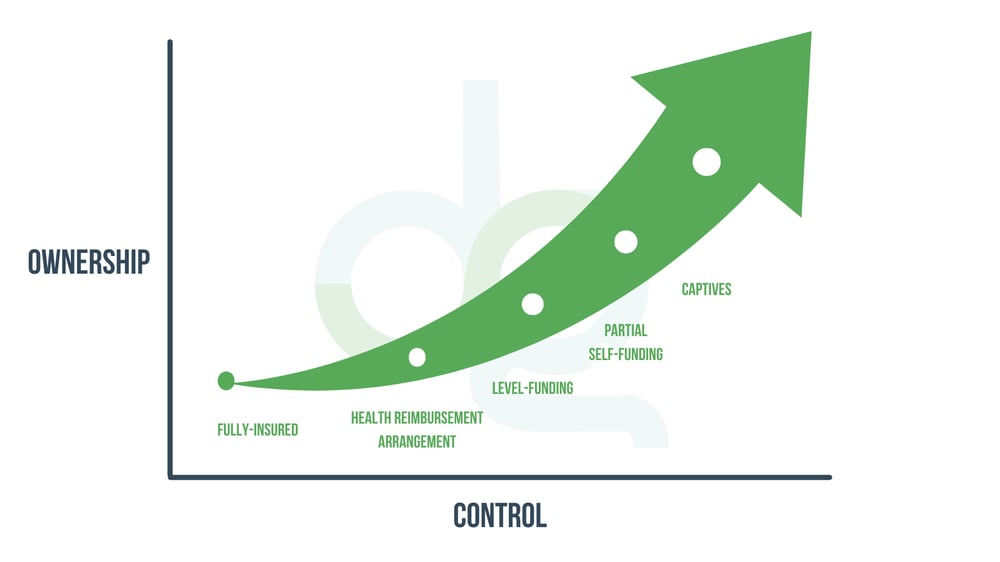

Where does your health insurance plan fall on this graph?

This chart illustrates a fundamental truth about employer-sponsored health insurance: the more control and ownership you want, the further you have to move away from the fully-insured model.

Yet, year after year, many employers stay stuck on the far left—fully-insured, at the mercy of their carrier’s renewal terms, with little transparency and zero leverage.

If you’re fully-insured, you don’t own your plan—you’re renting it.

That means every renewal becomes a guessing game, and most years you’re forced to pay more for the same coverage. No insight. No options. No control.

If you want to break that cycle, it’s time to explore alternative funding strategies that give you more insight, more control, and a path to meaningful cost containment.

Here are four options to consider—and how they move you up and to the right on the control/ownership scale:

🔹 Health Reimbursement Arrangement (HRA)

Control: Low to Moderate | Ownership: Low

Want to dip your toes into cost control without fully giving up your insured plan? HRAs let you stick with a traditional fully-insured model, but reimburse employees tax-free for out-of-pocket medical expenses.

HRAs are a great first step. You maintain the familiarity of a fully-insured plan while creating more flexibility and potentially lowering your premium costs.

🔹 Level-Funding

Control: Moderate | Ownership: Moderate

Level-funding is a bridge between fully-insured and self-funded models. You pay a fixed monthly amount (just like a premium), but it’s divided into three buckets: claims funding, stop-loss insurance, and administrative costs.

If your claims come in lower than expected, you get money back. If they’re higher, stop-loss coverage kicks in. The benefit? More transparency and the chance to save, without the volatility of fully self-funded plans.

🔹 Partial Self-Funding

Control: High | Ownership: High

Ready to take the reins? Partial self-funding means you pay employee claims directly, up to a stop-loss threshold. This gives you maximum visibility into where your money is going and more opportunity to bend the cost curve through smart strategies like direct contracting and pharmacy benefit optimization.

Yes, there’s more risk. But with the right guidance and data, the rewards can far outweigh it.

🔹 Captives

Control: Very High | Ownership: Very High

Want to buy insurance like the Fortune 500? Captives allow like-minded employers to band together and form their own insurance entity. You share risk, spread fixed costs, and gain negotiating power that smaller employers don’t typically enjoy.

Captives are the ultimate step in plan ownership—and while they’re not for everyone, they’re worth exploring if you’re tired of playing by the carrier’s rules.

Bottom Line: Don’t Stay Where You Are

Staying fully-insured may feel safe, but it’s costing you. Lack of control and zero ownership guarantees your premiums will rise and you’ll be powerless to stop it.

The best time to start this conversation was last renewal. The second-best time? Right now.

Want help evaluating your options? Let’s talk. No pressure. Just an honest look at what’s possible when you stop renting your plan and start owning it.