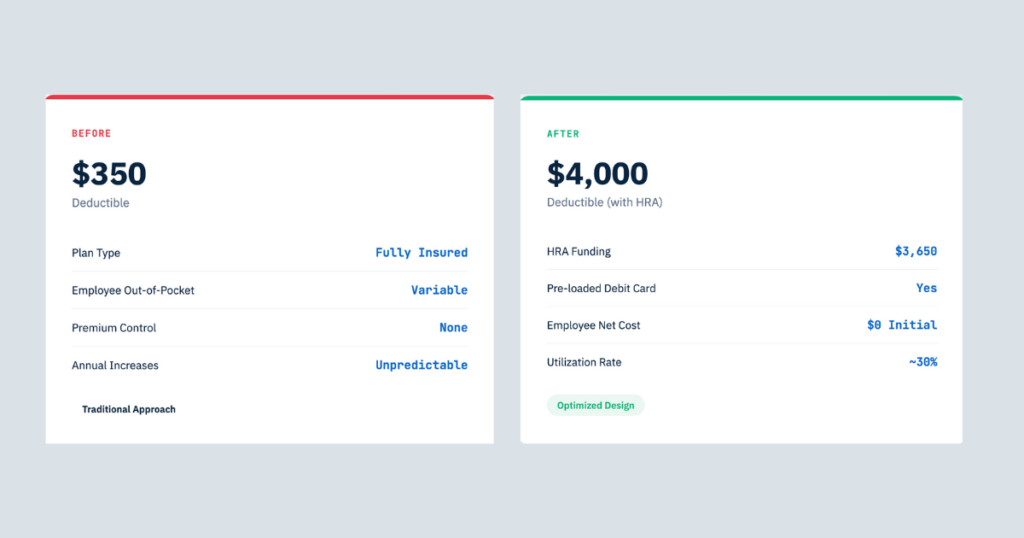

An Alabama manufacturing company with ~100 employees was bleeding money on a $350 deductible plan. Premium increases every year. Employees still paying out of pocket. The classic trap that fully insured plans keep employers locked into.

Their previous broker probably told them this was just “the market.”

That’s lazy thinking.

What We Did

We redesigned their entire approach using an HRA (Health Reimbursement Arrangement).

Here’s the breakdown:

The Change:

- Moved from a $350 deductible to $4,000 deductible plan

- Created a front-end funded HRA with pre-loaded debit cards

- Each employee received $3,650 on their card upfront

The Result: First year savings: $95,000. And we’re talking about upgrading their coverage, not downgrading it.

Why This Works

The math is simple once you understand utilization. Not all 100 employees will hit that $4,000 deductible. The data tells us about 30% will use the full amount.

By funding the HRA upfront on debit cards, employees had zero out-of-pocket costs for their initial care. They’re not worried about affording their healthcare. They’ve got the funds sitting right there.

Meanwhile, the employer is paying lower premiums on the high-deductible plan and controlling exactly how much they’re funding toward healthcare costs.

Three Years Later

This company is still running this program. Still saving money. Still way below where they were with that $350 deductible plan their previous broker locked them into.

That’s sustainability. That’s a plan built to last, not just negotiated down 5% for the year.

HSA vs HRA: The Difference

Let’s clear something up because most people confuse these:

HRA (Health Reimbursement Arrangement):

- Employer-funded only

- The “R” stands for reimbursement

- Employer controls the money

- Doesn’t follow employee if they leave

HSA (Health Savings Account):

- Requires High Deductible Health Plan

- Employee owns the account

- Triple tax benefit: pre-tax contributions, tax-deferred growth, tax-free distributions for medical expenses

- Portable. Follows the employee forever

- Employees can (and should) contribute their own money

What This Means For You

Ask your current advisor these questions:

- Have you analyzed whether self-funding with an HRA makes sense for us?

- What’s our actual claims data showing about utilization?

- How much are you earning in overrides and bonuses above your disclosed commission?

If they can’t answer or won’t answer, you know what you’re dealing with.

The Alabama company isn’t an outlier. Their blue-collar workers now have better coverage, and their employer saved nearly six figures.

DM me for more information if you want to see what your actual options are beyond the spreadsheet your current broker runs every renewal season.